So, the “new” of the New Year has come and gone and one of the biggest resolutions normally right behind losing weight is saving money.

Let me preface this by saying, I am not a financial expert. I am a wife and mom trying to help our family remain a one income family. We have been a one income family for many years now and it has sometimes been extremely difficult. I must tell you that first and foremost, I give all glory to God because without His guidance there would be no story! It’s all His and He has freely given us exactly what we’ve needed.

In practical applications, the biggest thing that works for us is to set up a budget to tell our money where to go before we even get it!

This is the system that I have set up that works for us. Our family has not always been on a budget so I can tell you from experience that your money is going to go somewhere. You might as well tell it where you want it to go!

Budgeting doesn’t have to a burden – it’s actually quite fun when you see the money you can save! I am a huge fan of Dave Ramsey so we do apply some of the principles that he teaches. We also do a few that he wouldn’t agree with but the point is to do what works for you. If it doesn’t work for you, then you are not going to stick with it and that isn’t going to work!

Here are some things that we do to set up our budget and stick with it:

Budget Percentage Guidelines

- Charitable Gifts 10-15%

- Savings 5-10%

- Housing 25-35%

- Utilities 5-10%

- Transportation 10-15%

- Food 5-15%

- Clothing 2-7%

- Medical/Health 5-10%

- Personal 5-10%

- Recreation 5-10%

- Debt 5-10%

I will share ours to help you get started:

- Tithing – do not skip this step! It is number 1! Here’s what God says . . . Malachi 3:10 “Bring all the tithes into the storehouse so there will be enough food in my Temple. If you do,” says the Lord of Heaven’s Armies, “I will open the windows of heaven for you. I will pour out a blessing so great you won’t have enough room to take it in! Try it! Put me to the test!”

- Housing – this includes our mortgage, mortgage insurance, house repair, house taxes

- Utilities – includes electric, propane, water, phone, and internet

- Auto – gas, repairs and insurance – we don’t have any auto payments and haven’t had any in about 10 years!

- Groceries

- Insurance – life and health

- Debt Snowball – remember, we haven’t always been diligent with budgeting

- Recreation – this category for us includes eating out, movies, weekend money

- Clothing

- Savings

- Gifts – birthdays and Christmas

- Kids Expenses – dance classes, costume fees, summer camps, homeschool expenses

- Envelope System

The categories above marked in go into an envelope system. This is new for us this year. We have been a cash family for weekend money, auto gas, and groceries for many years but decided to do the envelope system this year for long term budgeting expenses as well.

For our weekly cash items (groceries, auto gas, and, I get the amount of cash out of the bank each paycheck that we have designated. The key to this is when the cash runs out so does the spending! The amount we have budgeted is $160 weekly but it can vary depending upon paycheck amount, bill amount, etc.

For the other red categories, I look at what was spent the previous year and divide that by the amount of time that I have left to save for and that much money goes into the envelope each month. For instance, if your Christmas budget is $1,000 and you begin saving in January and want to have the total saved by the December 1st then you would put $91 each month into your Christmas envelope. If you are just beginning and don’t have “a last year amount” to go by then estimate what you think it will be. You will be tweaking until you get pretty close. This usually will take you about 3-6 months.

Budgeting Sheets

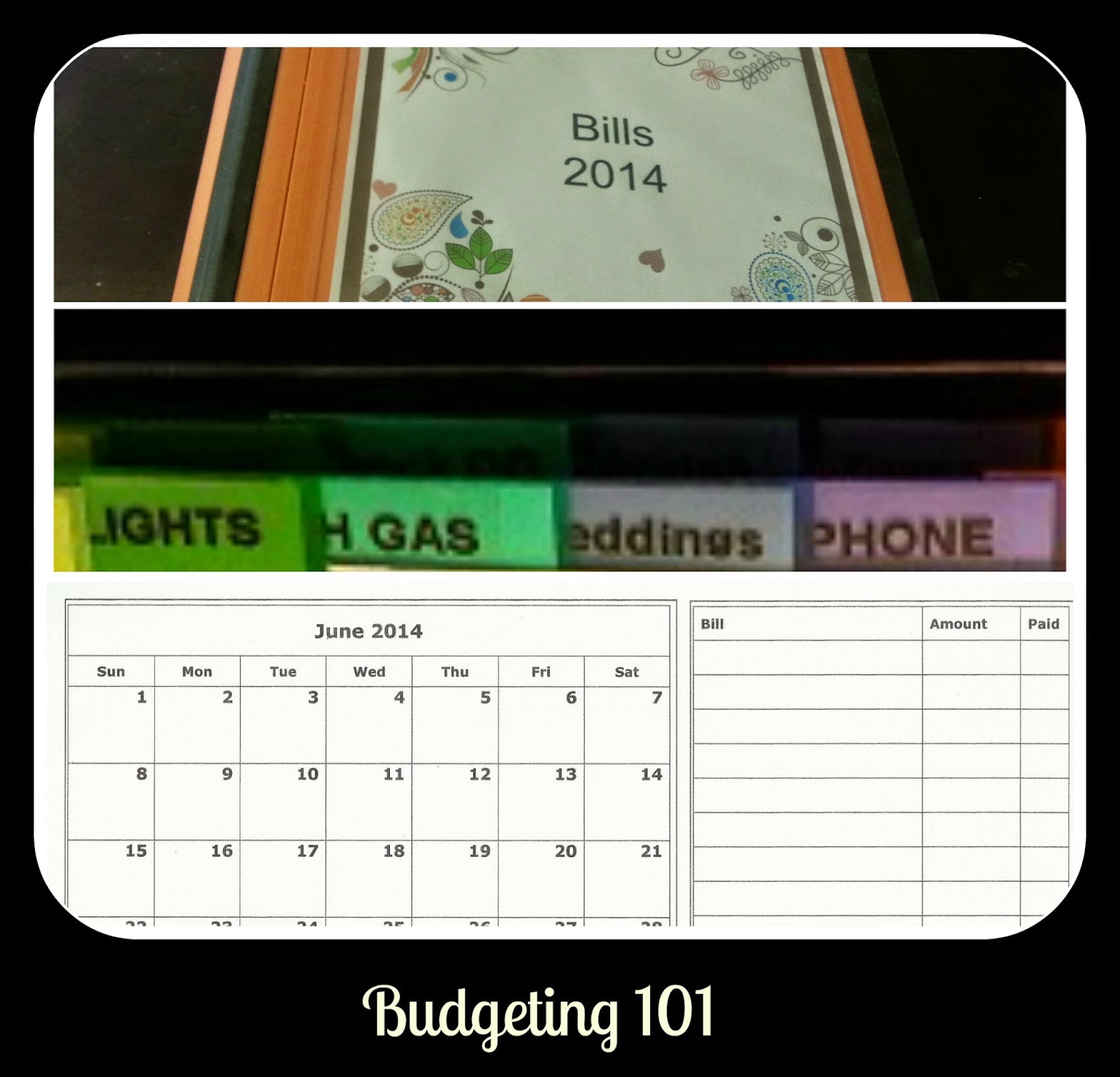

Before the month begins, I write down our budget on my budgeting sheets that I created. I place a circle around payday dates. There is also a section to keep up with any debt snowball accounts you are currently working on. Find out more about debt snowball. You can download my budgeting sheets for free! Here is what they look like.

As I pay the bill, I write what I actually spent and file the bill in our Paid Bills binder. I create a new binder every year and keep them for 5 years.

The biggest money saver that I can share with you is watch your grocery bill. If you haven’t been, you can really save some money in this category. Meal plan, stick to your list, and try to make not going over your budget a game – it’s fun! We could spend a lot of money on groceries but sticking to a budget in this area can save thousands of dollars a year! As our family is hitting a new milestone full of teenagers, we are seeing an increase in our budget. I’m still trying to keep it at $500 per month after sticking to $400 for many years.

This one is very hard for me to type although easier now than it use to be. Stop eating out constantly! I’m not at a place yet to say stop eating out completely but boy oh boy can you save money by just eating at home! Prices continue to go up in this area and even the dollar menu costs our family of five at least $16-$17 each time. This would be the first place I’d look to cut if you want to save money quickly.

We use our credit card for our weekly gas. We can save 8 cents a gallon each week doing that so we do it. We pay the bill off every month using the cash that we have taken out and put in the gas envelope each week. If we ever get to a point where we do not pay it off monthly, we would stop. This is a recommendation that Dave Ramsey would not agree with but it works for us.

If you are not a pen and paper person like me, there is also a great excel spreadsheet available from for free from Pear Budget. I like to use this system as well to help track what we spend monthly and annually.

Dave Ramsey also has budgeting software, articles, and other resources.

I would love to hear from you! Please share any tips on how your family sets up a budget.

You can follow along on Melissa’s debt free journey and homeschool days over at Grace Christian Homeschool. She is looking forward to one day screaming, “We’re debt free!”

You can follow along on Melissa’s debt free journey and homeschool days over at Grace Christian Homeschool. She is looking forward to one day screaming, “We’re debt free!”